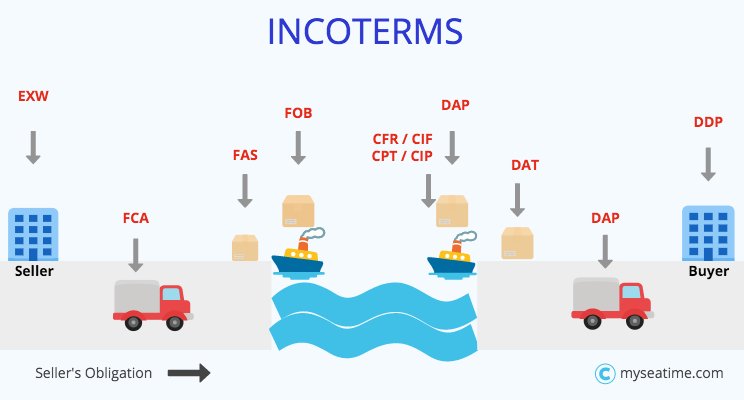

INCOTERMS 2010

EXW—Ex Works: the seller ‘delivers’ when he or she places the goods at the disposal of the buyer at the seller’s premises or another named place. The goods will not have been cleared for export and not loaded onto any collecting vehicle. Under Ex-Works the seller has no obligation to load the goods.

FCA—Free Carrier: the seller delivers the goods, cleared for export, to the carrier nominated by the buyer at the named place. It should be noted that the chosen place of delivery has an impact on the obligations of loading and unloading the goods at that place. If delivery occurs at the seller’s premises, the seller is responsible for loading. If delivery occurs at any other place, the seller is not responsible for unloading.

CPT—Carriage Paid To: the seller delivers the goods to the carrier nominated by him or her but the seller must, in addition, pay the cost of carriage necessary to deliver the goods to the named destination.

CIP—Carriage and Insurance Paid To: the seller delivers the goods to the carrier nominated by them but the seller must in addition pay the cost of carriage necessary to deliver the goods to the named destination and also pay the necessary insurance. Here the seller is obliged to provide only minimum coverage, i.e. cover for loss or damage between the point of departure and the destination stipulated.

DAT (new)—Delivered At Terminal: the seller is considered to have delivered when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named terminal at the named port or place of destination. Terminal in this case includes any place, whether covered or not, such as a quay, warehouse, container yard or road, rail or air cargo terminal. Under this term the seller must bear all costs and risks in bringing the goods to and unloading them at the terminal at the named port of destination. In addition to these obligations, the seller must also clear the goods for export under what is generally referred to as ‘Export Clearances’, where applicable. However, the seller has no obligation either to clear the goods for import or to pay any import duty or carry out any import customs formalities.

DAP (new)—Delivered At Place: the seller is considered to have delivered when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. The critical part of this new Incoterm is that all parties under what circumstances must clearly specify as clearly as possible the point within the agreed place of destination as the risks to that point are the account of the seller. In this regard, it is also very important to note that since the seller under DAP is responsible the procuring the contract of carriage he or she has to make sure that he or she procures the contracts of carriage that matches and conform precisely to the buyers choice.

DDP—Delivered Duty Paid: the seller delivers the goods to the buyer, cleared for import and not unloaded from any arriving means of transport at the named place of destination. Under DDP there is maximum obligation to the seller and, on the other hand, this option allows minimum obligation on the buyer. The only responsibility of the buyer under DDP is to offload at the delivery place. General guidance as a seller is to never contract under DDP. If the seller is unable to directly or indirectly obtain import clearances DAP is recommended. Any VAT or other taxes payable upon import are for the seller’s account unless expressly agreed otherwise in the sales contract.

FAS—Free Alongside Ship: the seller is considered to have delivered when the goods are placed alongside the vessel at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment. The seller should select a point other than physically ‘alongside the ship’ it is essential that under FAS the buyer indicates a loading point at the named port of shipment and give the seller sufficient notice of the vessel’s name, loading point and, where necessary, selected delivery time within the agreed period. In the event that the buyer fails to give these details, the seller may use his discretion to select a point that best suits his purposes; but, in any case, that point should be alongside the ship. In the event that the buyer has given an indication of the loading point but later wishes to change these instructions, the seller is not obliged to cover the cost of transferring the goods to a new loading point, provided that the seller has acted in line with the buyer’s first instruction.

FOB—Free On Board: the seller is considered to have delivered when the goods are placed on board the ship at the named port of shipment. Most will no longer use FOB/CFR/CIF for container-loaded goods. This is because, where goods in a container are sold FOB, the container is typically handed over by the seller at a container yard or warehouse, which is in practice the appropriate delivery point. Under FOB, the seller bears all the costs, risks of loss of and damage to the goods until they are delivered by being placed on board the vessel, it is recommended that for all containerised goods, buyers should opt for Incoterms such as FCA, CPT or CIP.

CFR—Cost and Freight: the seller is considered to have delivered when the goods are placed on board the ship in the port of shipment. The seller must, in addition, pay the cost of carriage necessary to bring the goods to the named destination. Although under this Incoterm the issue of insurance is silent, it is assumed that the buyer purchases his or her own insurance.

CIF—Cost Insurance and Freight: the seller is considered to have delivered when the goods are placed on board the ship in the port of shipment and also pays the necessary freight and insurance (CIF). It is important to note that contracts placed CIF relieve the buyer of the task of making insurance arrangements. However, the disadvantages are many: under CIF the supplier is obliged only to buy the cheapest insurance coverage, with minimal coverage and conditions that may make a claim difficult.

Incoterms and the transfer of risk

It is necessary for an individual to decide whether to retain risk or endeavour to transfer it to the other party. The most common form of risk transfer is by means of insurance which changes an uncertain exposure to a certain cost, i.e. premium that can be budgeted for. In normal circumstances insurance premiums include provision for insurers’ overheads and profit plus contributions for the catastrophe element. When dealing with Incoterms, every individual, company or government department is exposed to a wide range of risks. It is inevitable, by nature of probability that financial loss will occur sooner or later. The Incoterm you select for a particular situation should assist you in minimising the risk exposure for your company and in the most cost effective manner available

Incoterm Transfer of risk

EXW When the goods are at the disposal of the buyer

FCA When the goods have been delivered to the carrier at the named place

FAS When the goods have been placed alongside the ship

FOB When the goods are on board vessel, at the port of export (origin)

CFR When the goods are on board vessel, at the port of export (origin)

CIF When the goods are on board vessel, at the port of export (origin)

CIP When the goods have been delivered to the main carrier, at the port of export (origin)

CPT When the goods have been delivered to the main carrier, at the port of export (origin)

DAT When the goods once unloaded from the arrival means of transport and are placed at the disposal of the buyer at a named port or place of destination

DAP When the goods are placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the named place of destination

DDP When goods are placed at the disposal of the buyer having been cleared for import and ready for unloading at the named place of destination.

Contracts and the use of the Incoterms 2010 rules

It is critically important during the tendering process, depending on the type of sourcing, whether strategic, tactical or project, that the terms of sales be discussed upfront and at every stage of the contract-formulation process. More importantly, all stakeholders should be aware of both the advantages and the disadvantages of each Incoterm in order to be able make appropriate decisions when dealing with international trade transactions.

The following have to be noted before concluding and signing a contract (this is a requirement introduced by the Incoterms 2010 rules):

1. Specify your place of departure or port as precisely as possible:

If both parties agree on the use of a certain port or named place of departure, it is very important to name it as precisely as possible. This will avoid potential disputes as a result of ambiguity regarding the place. This lack of specifying a place was probably one of the reasons why the experts responsible for the revision decided to incorporate this important point. For example, if both parties agree on FCA Incoterms, it would be advisable to state the arrangement as:

‘Unit 23 Rainbow Industrial Park, Gillette Avenue, Reading, UK as per Incoterms® 2010.’

This is very specific and the seller will have a clear understanding that he or she will fulfil his or her obligation only once delivery has taken place to the stated address.

2. The specific Incoterm should be incorporated in the contract of sale:

Incoterms apply only if incorporated in the contract of sale or if they are, for example, mentioned in the offer, the sales conditions, the purchase order, the confirmation of an order or if they are stipulated by the parties in separate agreement. With the new revised set of Incoterms and their requirements, it is important to note that whenever you want the Incoterms to apply to your contract, legal members who participate as a cross-functional team must make sure that they should make it clear in their contract through such words as:

‘The chosen Incoterms rule including named place or port followed by Incoterms® 2010’.

In addition to this, it must be stressed that when the parties intend to incorporate Incoterms into their contracts of sale, they should always make an expressed reference to the current version of these terms.

3. Appropriate Incoterms must be chosen:

Whenever Incoterms are chosen, it has to be stressed that they must be appropriate to the goods (type, weight, dimensions) that are going to be imported or delivered. In addition, the means of transport (road, rail, air or sea) also plays an influential role in the selection of the appropriate terms of sale. Certain types of goods cannot be delivered by air because of their excessive weight. However, whichever Incoterm will have been chosen or agreed upon, both parties should always be aware that the interpretation of their contract may well be influenced by customs at a particular port or place being used. It must be emphasised that all the personnel in a company responsible for concluding the contracts must be well trained and have a full understanding of the different Incoterms and their implications, because choosing the wrong or an inappropriate Incoterm for a specific situation may be very costly.

4. Be aware that Incoterms rules do not give a complete contract of sale:

It is important to ensure that other contractual obligations are incorporated separately, for example payment terms, transfer of ownership of goods and also the consequences of a breach of contract that are normally dealt with in a service-level agreement (SLA). If parties make the assumption that all other contractual aspects are covered by a chosen Incoterm, it will have seriously negative repercussions. Many disputes are as a result of the trading community not understanding the importance of creating a contract of sale that looks after the interest of both the seller and the buyer.

Common errors made by importers and/or exporters in the use of Incoterms in contracts

Despite the fact that Incoterms were developed to simplify international transactions and to make their application in international trade more precise, there are still a number of reasons why they often fail to achieve their intended purpose. In most cases, it is due to lack of knowledge of the terms as well as inaccuracy and even too little effort put in when utilising or applying them. The following have been identified as the problems most frequently associated with use of Incoterms:

1. Most people use a sea-freight term such as FOB or CIF when consigning goods by air or road freight.

2. Incoterms are not quoted at all in the contracts. This makes it very difficult to apportion responsibilities to either the buyer or seller and even to manage and/or monitor these contracts

3. Doing more under the term than required, for example, loading under ‘Ex-Works’.

4. Out-dated Incoterms being used. Many people are not aware that a new version of the Incoterms was issued in January 2010 and that some original Incoterms—such as DDU, DES DAF and DEQ—are no longer in use. Many, however, still continue making use of them. Worse still, one may find that an Incoterm is quoted followed by 2000 instead of year 2010 or no year at all. Although, in a few cases, this may not mean much difference when considering the obligations, but in certain cases, for example FCA, there are very significant differences and the use of the wrong edition can be critical.

5. Incorrect abbreviation of the Incoterm are being quoted. One will occasionally come across situations where the invoice does not indicate the full Incoterm. For example using Ex-works instead of EXW and while it may still be possible or logical to work out which Incoterm was involved it should be pointed out the seller or buyer that the correct version always has three letters

6. Not being protected against when things go wrong because the ‘term’ quoted has never been reviewed against the legal issues. In practice, some contracts have quoted the unrecognised Incoterms such as Delivered Cost Included (DCI) or Delivery Cost Excluded (DCE). This is dangerous as these terms are not recognised by legal authorities and therefore using these terms might lead a company having no recourse should a dispute arises out of the use of these unrecognised or illegal terms.

7. Parties choose the wrong Incoterm for their particular trade. It is common practice that some people use DDP, when the seller is unable to meet the registration requirements of overseas customs authorities.

8. Parties fail to reference the Incoterm with sufficient clarity. The issue of precision where lack of familiarity with the terminology results in terms such as: FOB South African port being quoted or shown. This will result in all the relevant costs covered by the Incoterms rule being included. While this may be due to the parties wanting to cover all eventualities, it is critical for the preparation of the quotation or estimate that the exact port is known when working out the transport costs,

9. The mode of transport not taken into consideration. Certain shipments are more suited to a particular Incoterm, owing to the method/mode of transport used. It is therefore critical, when, if the way in which the cargo is transported changes, then the existing Incoterm should be reviewed for suitability. With the advent of multi-modalism there are certain commodities and cargo that are now being containerised which were previously transported as break-bulk.

10. Resistant to change—conservatism. Sellers may have used terms such as FOB or DDP for several years without an issue and it is not easy to convince clients that they are using an inappropriate or unsuitable Incoterm until an issue arises and a loss is suffered.

Source: https://www.linkedin.com/pulse/incoterms-2010-how-use-them-contract-simon-minett/?trackingId=EeaGqNMkF%2B3yMA4tWI9heA%3D%3D